UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE SECURITIES

EXCHANGE ACT OF 1934

(AMENDMENT NO.

)| Filed by the Registrant ☒ | Filed by a Party other than the Registrant ☐ |

Check the appropriate box:

☐ | |

Preliminary Proxy Statement |

☐ | |

CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14a-6(e)(2)) |

☒ | |

Definitive Proxy Statement |

☐ | |

Definitive Additional Materials |

☐ | |

Soliciting Material Pursuant to Section 240.14a-12 |

BANKFINANCIAL CORPORATION

(Exact Name of Registrant as Specified in Charter)

(NAME OF PERSON(S) FILING PROXY STATEMENT, IF OTHER THAN THE REGISTRANT)

Payment of Filing Fee (Check the appropriate box)

☒ | |

No fee required. |

| ☐ | Fee paid previously with preliminary materials. |

☐ | |

Fee computed on table |

| May 9, 2024 | ||

Dear Fellow Stockholder:

On behalf of the Board of Directors of BankFinancial Corporation (the “Company”), I cordially invite you to attend our 20162024 Annual Meeting of Stockholders. The meeting will be held at the Drake Hotel Oak Brook, 2301 York Road, Oak Brook,Chicago Marriott Southwest at Burr Ridge, 1200 Burr Ridge Pkwy., Burr Ridge, Illinois, on Tuesday,

At the Annual Meeting, our stockholders will vote on the election of

The Board of Directors, acting on the recommendations of the Corporate Governance and Nominating Committee, has nominated incumbents John M. HausmannCassandra J. Francis and GlenTerry R. WherfelWells to serve as directors of the Company for three-year terms.

The Board of Directors recommends that you vote your shares as follows:

FOR the election of our two director nominees; FOR the ratification of the appointment ofWe are using the “Notice and Access” method of providing proxy materials to you via the Internet in accordance with the rules and regulations of the Securities and Exchange Commission (“SEC”). We believe that this process should provide you with a convenient and quick way to access your proxy materials and vote your shares, while allowing us to conserve natural resources and reduce the costs of printing and distributing the proxy materials. On or about April 29, 2016,May 9, 2024, we will mail to our stockholders a Stockholder Meeting Notice (“Meeting(the “Meeting Notice”) containing instructions on how to access our Proxy Statement and 20152023 Annual Report, and how to vote your shares. This noticeThe Meeting Notice will also contain instructions on how you may receive, if you wish, a paper copy of your proxy materials.

By voting your shares promptly, you will help us reduce the time and expense of soliciting proxies, and you will also ensure that your shares are represented at the Annual Meeting.

Thank you in advance for your attention to this important matter. We are most appreciative of your continued interest and support as stockholders of the Company and as valued customers of BankFinancial, F.S.B.NA.

| Very truly yours, | ||

| ||

F. Morgan Gasior Chairman and Chief Executive Officer |

BANKFINANCIAL CORPORATION

60 North Frontage Road

Burr Ridge, Illinois 60527

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held On

Friday, JuneTo the Stockholders of BankFinancial Corporation:

Notice is hereby given that the Annual Meeting of Stockholders (the “Annual Meeting”) of BankFinancial Corporation a Maryland corporation, will be held at the Drake Hotel Oak Brook, 2301 York Road, Oak Brook,Chicago Marriott Southwest at Burr Ridge, 1200 Burr Ridge Pkwy., Burr Ridge, Illinois, on Tuesday,

The purpose of the Annual Meeting is to consider and act upon the following, as described more fully in the Company’s Proxy Statement:

1. | To elect two directors for a three-year term and until their successors are duly elected and qualify; |

2. | To ratify the engagement of |

| 2024; | ||

3. | An advisory, non-binding resolution to approve our executive compensation; |

| 4. | A stockholder proposal, if properly presented at the annual meeting. | |

5. | To transact such other business as may properly come before the Annual Meeting, or any adjournments or postponements |

The Board of Directors has fixed the close of business on

| By Order of the Board of Directors | ||

| ||

| James J. Brennan | ||

| Secretary |

Burr Ridge, Illinois

May 9, 2024

Important Notice Regarding the Availability of Proxy Materials for the 20162024 Annual Meeting

Our Proxy Statement for the

2024 PROXY STATEMENT

PROXY STATEMENT

BankFinancial Corporation

60 North Frontage Road

Burr Ridge, Illinois 60527

ANNUAL MEETING OF STOCKHOLDERS

Friday, June 28, 2016

This Proxy Statement is furnished in connection with the solicitation by the Board of Directors of BankFinancial Corporation of proxies to be voted at the Annual Meeting of Stockholders (the “Annual Meeting”) that will be held at the Drake Hotel Oak Brook, 2301 York Road, Oak Brook,Chicago Marriott Southwest at Burr Ridge, 1200 Burr Ridge Pkwy., Burr Ridge, Illinois, on Tuesday,

This Proxy Statement and the accompanying Notice of Annual Meeting and proxy card are first being made available to the stockholders of BankFinancial Corporation on or about

An Annual Report for the year ended

December 31,BankFinancial Corporation, a Maryland corporation headquartered in Burr Ridge, Illinois, became the owner of all of the issued and outstanding capital stock of BankFinancial, NA, formerly known as BankFinancial, F.S.B. (the(each referred to herein as the “Bank”) on June 23,in 2005, when it consummated a plan of conversion and reorganization thatof the Bank and its predecessor holding companies, BankFinancial MHC, Inc. (“BankFinancial MHC”) and BankFinancial Corporation, a federal corporation, adopted on August 25, 2004. BankFinancial Corporation, the Maryland corporation, was organized in 2004 to facilitate the mutual-to-stock conversion, and to become the holding company for the Bank upon the completion of the mutual-to-stock conversion.

The following is information regarding the Annual Meeting and the voting process.

Why am I receiving this Proxy Statement?

Our Board of Directors has made these materials available to you on the Internet or has delivered printed versions of these materials to you by mail pursuant to your request in connection with the Board of Directors’ solicitation of proxies for use at our Annual Meeting. As a stockholder, you are invited to attend the Annual Meeting and are requested to vote on the items of business described in this Proxy Statement.

You are receiving this Proxy Statement from us because at the close of business on

When you vote your shares, you appoint the proxy holder as your representative at the Annual Meeting. The proxy holder will vote your shares as you have instructed, thereby ensuring that your shares will be voted whether or not you attend the Annual Meeting. Even if you plan to attend the Annual Meeting, please vote your shares in advance of the Annual Meeting in case your plans change.

If you have voted your shares and an issue comes up for a vote at the Annual Meeting that is not identified on the proxy card, the proxy holder will vote your shares, pursuant to your proxy, in accordance with his or hertheir discretion.

What matters will be voted on at the Annual Meeting?

You are being asked to vote on the election of our

two director nominees; the ratification of the engagement ofThese matters are more fully described in this Proxy Statement.

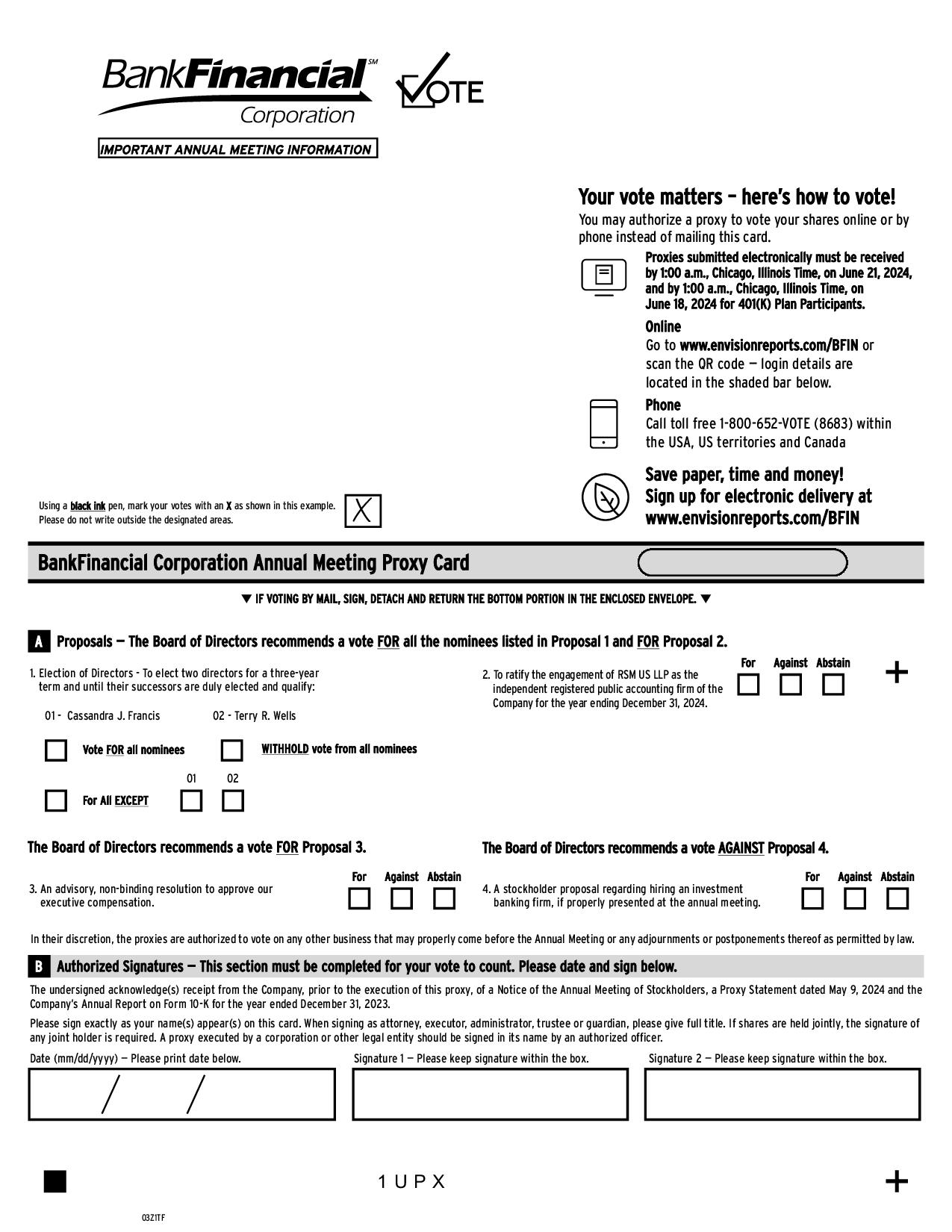

How do I vote?

Stockholders who own their shares in their name may vote in person at the Annual Meeting by filling out a ballot or may authorize a proxy to vote on his or hertheir behalf. There are three ways to authorize a proxy:

1. | Internet : You may access the proxy materials on the Internet at www.envisionreports.com/BFIN and follow the instructions on the proxy card or on the Meeting Notice. |

2. | Telephone: You may call, toll-free, 1-800-652-VOTE (8683) and follow the instructions provided by the recorded message. |

3. | Mail: If you received your proxy materials by mail, you may vote by signing, dating and mailing the enclosed proxy card in the postage paid envelope provided. |

You may use the Internet or telephone to submit your proxy until 1:00 a.m.A.M., Chicago, Illinois Time on the morning of the Annual Meeting,

Stockholders who hold shares in “street name,” that is, through a broker, should instruct their broker to vote their shares by following the instructions provided by the broker. Your vote as a stockholder is important. Please vote as soon as possible to ensure that your vote is recorded. See “If I hold shares in the name of a broker, who votes my shares?” below.

What if I sign and date my proxy but do not provide voting instructions?

A proxy that is signed and dated, but which does not contain voting instructions will be voted as follows:

• | “FOR” the two director nominees named in this Proxy Statement; | |

• | “FOR” the ratification of the engagement of RSM US LLP; | |

• | “FOR” the approval of the advisory, non-binding resolution to approve our executive compensation; and | |

| • | “AGAINST” the stockholder proposal. |

What does it mean if I receive multiple proxy materials?

It means that you have multiple holdings reflected in our stock transfer records and/or in accounts with stockbrokers. Please vote all shares. No proxy cards are duplicated.

If I hold shares in the name of a broker, who votes my shares?

If you received this Proxy Statement from your broker, your broker should have given you instructions for directing how your broker should vote your shares. It will then be your broker’s responsibility to vote your shares for you in the manner you direct.

Under the rules of various national and regional securities exchanges, brokers may generally vote on routine matters, such as the ratification of an independent registered public accounting firm, but cannot vote on non-routine matters such as the election of directors and advisory, non-binding votes on executive compensation unless they have received voting instructions from the person for whom they are holding shares. If your broker does not receive instructions from you on how to vote particular shares on matters on which your broker does not have discretionary authority to vote, your broker will return the proxy card to us, indicating that he or she does not have the authority to vote on these matters. This is generally referred to as a “broker non-vote.” At the Annual Meeting, broker non-votes will not affect the outcome of the voting, as described below under “How many votes are needed for each proposal?” Therefore, weWe encourage you to provide directions to your broker as to how you want your shares voted on the matters to be brought before the Annual Meeting. You should do this by carefully following the instructions your broker gives you concerning its procedures so that your shares will be voted at the Annual Meeting.

What if I change my mind after I vote my shares?

If you hold your shares in your own name, you may revoke your proxy and change your vote by:

• | following the instructions for telephone or Internet voting appearing on your proxy card; |

• | signing another proxy card with the later date and returning the new proxy card by mail to our stock transfer agent and registrar, Computershare Trust Company, N.A., or by sending it to us to the attention of the Secretary of the Company, provided that the new proxy card is actually received by the Secretary before the polls close at the Annual Meeting; |

• | sending notice addressed to the attention of the Secretary of the Company that you are revoking your proxy, provided that the notice is actually received by the Secretary before the polls close at the Annual Meeting; or |

• | voting in person at the Annual Meeting in accordance with the established voting rules and procedures. |

If you hold your shares in the name of a broker and desire to revoke your proxy, you will need to contact your broker to revoke your proxy.

Please mail any new proxy cards to Proxy Services, in care of Computershare Trust Company, N.A.,Investor Services, at P.O. Box 43101, Providence, Rhode Island 02940-5067. YouRI 02040-5067 or you may send the notice described above or new proxy card to us as follows: BankFinancial Corporation, 15W06060 North Frontage Road, Burr Ridge, Illinois 60527, Attention: James J. Brennan, Secretary.

How are proxy materials delivered?

BankFinancial controls its costs for the Annual Meeting by following SEC rules that allow for the delivery of proxy materials to the Company’s stockholders via Notice and Access, which delivers materials through the Internet. In addition to reducing the amount of paper used in producing these materials, this method lowers the costs associated with mailing the proxy materials to stockholders. Stockholders who own shares directly and not through a broker will have a Meeting Notice delivered directly to their mailing address. Stockholders whose shares are held in the name of a broker willshould have a Meeting Notice forwarded to them by the broker that holds the shares. Stockholders who have requested paper copies of the proxy materials will receive this Proxy Statement, the 20152023 Annual Report and a proxy card.

If you received only a Meeting Notice by mail, you will not receive a printed copy of the proxy material unless you request a copy by following the instructions on the notice. The Meeting Notice also contains instructions for accessing and reviewing the proxy materials over the Internet and provides directions for submittingauthorizing your voteproxy over the Internet.

How do I request a paper copy of the proxy materials?

You may request a paper copy of the proxy materials by following the instructions below. You will be asked to provide your 15-digit control number located on your Meeting Notice.

1. | Call the toll-free telephone number 1-866-641-4276 and follow the instructions provided, or |

2. | Access the website at www.envisionreports.com/BFIN and follow the instructions provided, or |

3. | Send an email to investorvote@computershare.com with “Proxy Materials BankFinancial Corporation” in the subject line. Include in the message your full name and address, plus the number located in the shaded bar on your Meeting Notice, and state in the email that you want a paper copy of current meeting materials. |

Please make your request for a copy on or before June 8, 20167, 2024 to facilitate timely delivery before the Annual Meeting.

Stockholders who hold shares in “street name”name,” that is, through a broker, should request copies of the proxy materials by following the instructions provided by the broker.

How many votes do we need to hold the Annual Meeting?

A majority of the shares that are outstanding and entitled to vote as of the record date must be present in person or by proxy at the Annual Meeting in order for us to hold the Annual Meeting and conduct business. Abstentions and broker non-votes are considered present at the Annual Meeting and are counted in determining whether or not a quorum is present.

Shares are counted as present at the Annual Meeting if the stockholder either:

• | is present and votes in person at the Annual Meeting; or | |

• | has properly submitted a signed proxy form or other proxy (including a broker non-vote). |

At the close of business on

The Board of Directors may, by resolution, provide for a lesser number of directors or designate a substitute nominee. In the latter case, shares represented by proxies may be voted for the substitute nominee designated by the Board of Directors. Proxies cannot be voted for more than

two nominees. We have no reason to believe that any nominee will be unable to stand for election.What options do I have in voting on each of the proposals?

Election of Directors (Proposal 1).

You may mark the “FOR” box on your proxy card to vote for all director nominees, mark the “FOR ALL EXCEPT” box on your proxy card to vote for all nominees other than any nominee that you specify on your proxy card, or mark the “WITHHOLD” box to withhold your vote for all director nominees.Ratification of Independent Registered Public Accounting Firm (Proposal 2).

You may mark either the “FOR”, “AGAINST”, or “ABSTAIN” box with respect to the ratification of the engagement ofAdvisory, Non-Binding Vote on Executive Compensation (Say-On-Pay) (Proposal 3).

You mayStockholder Proposal (Proposal 4). You may mark either the “FOR”, “AGAINST”, or “ABSTAIN” box with respect to the stockholder proposal.

Where no instructions are indicated, validly executed proxies will be voted “FOR” the election of the

two director nominees, “FOR” the ratification of the engagement ofHow many votes may I cast?

Generally, you are entitled to cast one vote for each share of stock you owned on the record date. The proxy card included with this Proxy Statement indicates the number of shares owned by an account attributable to you.

Are there any limits on the voting of shares?

As provided in Section F of Article 6 of our Charter, record holders of common stock that is beneficially owned by a person who beneficially owns in excess of 10% of the outstanding shares of our common stock are not entitled to vote any shares held in excess of this 10% limit. Subject to certain exceptions, a person is deemed to beneficially own shares owned by an affiliate of, as well as by persons acting in concert with, such person. Our Board of Directors is authorized to construe and apply the provisions of Section F of Article 6 of the Charter, and to make all determinations it deems necessary or desirable to implement them, including determining the number of shares beneficially owned by any person and whether a person is an affiliate of or has an arrangement or agreement with another person. Further, the Board of Directors is authorized to demand certain information from any person who is reasonably believed to beneficially own stock in excess of the 10% limit and reimbursement for all expenses incurred by us in connection with an investigation conducted by the Board of Directors pursuant to the provisions of Section F of Article 6 of the Charter.

How many votes are needed for each proposal?

The

twoThe ratification of the engagement of Crowe HorwathRSM US LLP as our independent registered public accounting firm for the year ending

The approval of the advisory, non-binding voteresolution on executive compensation will require the affirmative vote of a majority of the votes cast at the Annual Meeting, without regard to either broker non-votes or shares as to which the “ABSTAIN” box has been selected on the proxy card. While this vote is required by law, it will neither be binding on the Company or its Board of Directors, nor will it create or imply any change in the fiduciary duties of or impose any additional fiduciary duties on the Company or its Board of Directors.

The approval of the stockholder proposal recommending that the Board engage an investment banking firm will require the affirmative vote of a majority of the votes cast at the Annual Meeting, electronically or by proxy, without regard to either broker non-votes or shares as to which the “ABSTAIN” box has been selected on the proxy card.

Shares represented by broker non-votes and abstentions are considered present at the Annual Meeting for the purposes of determining whether or not a quorum is present, but such shares are not considered votes cast and will have no effect on the

Where do I find the voting results of the Annual Meeting?

We intend to announce voting results at the Annual Meeting or at any postponements or adjournments thereof. The voting results will also be disclosed in a Current Report on Form 8-K that we will file with the SEC.

How does the Board recommend that I vote?

The Board of Directors recommends that you vote

“FOR” the election of the two directorWho do I call if I have any questions?

If you have any questions or need assistance in submitting your proxy, voting your shares or need paper copies of the proxy materials, free of charge, please contact Computershare, toll-free, at (866) 641-4276.

On February 7, 2024, the Board of Directors expanded its size to eight members from six members, and elected Aaron J. O’Connor and Benjamin Mackovak to the Company’s Board of Directors to fill the vacancies created by the increase in the size of the Board of Directors, whicheffective immediately. The Board of Directors is divided into three classes. The bylaws of the Company establish the initial terms of office for each class of directors and provide that directors are elected for a term of office that will expire at the third succeeding Annual Meeting of Stockholders following their election, with each director to hold office until his or hertheir successor is duly elected and qualifies.

At the Annual Meeting, the stockholders of the Company will be requested to elect one class of directors consisting of

two directors. The Corporate Governance and Nominating Committee of the Board of Directors has recommended, and the Board of Directors has nominated,The proxies solicited on behalf of the Board of Directors will be voted at the Annual Meeting “FOR” the election of the above

two director nominees as directors, provided that your proxy will not be voted in favor of any nominee for which your proxy vote has been withheld. If a nominee is unable or unwilling to stand for election at the time of the Annual Meeting, the shares represented by all such proxies will be voted for the election of such replacement nominee as the Board of Directors, acting on the recommendation of the Corporate Governance and Nominating Committee, may designate. At this time, the Board of Directors knows of no reason whyAs described in a Current Report on Form 8-K filed with the Securities and Exchange Commission on December 30, 2013,February 7, 2024, the Company has entered into a Standstill Agreement with John W. PalmerStrategic Value Bank Partners, LLC, Strategic Value Investors LP and PL Capital, LLCBenjamin Mackovak. Under the Standstill Agreement and certain of its affiliated parties (collectively,subject to the “PL Capital Parties”), pursuant to whichterms and conditions set forth therein, the Company agreed, among other things, that the Board of Directors of the Company and its Corporate Governance and Nominating Committee agreed, among other things,would appoint Mr. Mackovak to nominate and recommend Mr. Palmer for electionserve as a director of the Company in the class of directors with a term expiring at the 2014Company’s 2026 Annual Meeting of Stockholders. The PL Capital Parties agreed, among other things, that during the “Standstill Period” provided for in the Standstill Agreement, and as long as a designee of the PL Capital parties is a member of the Company’s Board of Directors, they will vote all Company shares that they beneficially own in favor of the director nominees selected by the Corporate Governance and Nominating Committee and will otherwise support such director candidates, and with respect to any other proposal submitted by any stockholder, they will vote all shares that they beneficially own in accordance with the recommendation of the Board of Directors.

The following table sets forth certain information regarding the nominees and other members of the Board of Directors, including their years of service and terms of office. Except for the Standstill Agreement or otherwise as indicated herein,elsewhere in the Proxy Statement, there are no arrangements or understandings between any of the directors or the nominees and any other person pursuant to which such directors or the nominees were selected.

| Name | Position(s) Held in the Company | Director Since (1) | Term of Class to Expire | |||

| NOMINEES | ||||||

| John M. Hausmann, C.P.A. | Director | 1990 | 2019 | |||

| Glen R. Wherfel, C.P.A. | Director | 2001 | 2019 | |||

| CONTINUING DIRECTORS | ||||||

| F. Morgan Gasior | Chairman of the Board, Chief Executive Officer and President | 1983 | 2017 | |||

| John W. Palmer | Director | 2014 | 2017 | |||

| Cassandra J. Francis | Director | 2006 | 2018 | |||

| Thomas F. O’Neill | Director | 2012 | 2018 | |||

| Terry R. Wells | Director | 1994 | 2018 | |||

Director | Term of Class | |||||

Name | Position(s) Held in the Company | Since (1) | to Expire | |||

NOMINEES | ||||||

Cassandra J. Francis | Director | 2006 | 2027 | |||

Terry R. Wells | Director | 1994 | 2027 | |||

CONTINUING DIRECTORS | ||||||

John M. Hausmann, C.P.A. | Director | 1990 | 2025 | |||

| Aaron J. O'Connor | Director | 2024 | 2025 | |||

Glen R. Wherfel, C.P.A. | Director | 2001 | 2025 | |||

F. Morgan Gasior | Chairman of the Board, Chief Executive Officer and President | 1983 | 2026 | |||

| Benjamin Mackovak | Director | 2024 | 2026 | |||

Debra R. Zukonik | Director | 2020 | 2026 |

(1) | |

Denotes the earlier of the year the individual became a director of |

Nominees

The business experience for at least the past five years of each nominee for election to the Board of Directors and the qualifications of each nominee to serve as a director areis set forth below, with age information as of December 31, 2015.

Cassandra J. Francis

. AgeMs. Francis brings to the Board, among other skills and qualifications, substantial experience in urban planning and commercial real estate development and operations, with particular emphasis in retail development and leasing. She also has extensive experience with commercial real estate finance and valuations, particularly in Midwestern markets.

Terry R. Wells. Age 65. Mr. Wells has served as the Mayor of the Village of Phoenix, Illinois since 1993, and he currently serves as President of the Southland Regional Mayoral Black Caucus. He is also a member of the Board of Directors of Pace, a Division of the Regional Transportation Authority (Illinois), and the Chairman of the Board of South Suburban College. Mr. Wells has served as President of the South Suburban Mayors and Managers Association. Mr. Wells retired in 2019 after 35 years teaching history at the secondary school level. He has been a director of the Company since its formation in 2004, and of the Bank since 1994. He was a director of the Company’s predecessors, BankFinancial MHC and BankFinancial Corporation, a federal corporation, from 1999 to 2005. Mr. Wells is a member of the Executive Committee, the Audit Committee, the Human Resources Committee and the Chairman of the Community and Environmental Committee of the Company.

Mr. Wells brings to the Board, among other skills and qualifications, substantial experience in municipal government and finance, community and economic development and serving the needs of low- and moderate-income borrowers and communities. His experience as an educator has also provided him with significant expertise in secondary and post-secondary vocational training applicable to the Bank’s customer service and support personnel.

The Board of Directors recommends a vote “FOR” the above nominees.

Continuing Directors

The business experience for at least the past five years of each continuing member of the Board of Directors and each individual’s qualifications to serve as a director are set forth below, with age information as of December 31, 2023.

F. Morgan Gasior.

AgeMr. Gasior brings to the Board, among other skills and qualifications, a comprehensive understanding of the Bank’s strategies, operations and customers based on his more than 30 years of service as an employee and officer of the Bank. He has led the development and implementation of the Bank’s financial, lending, operational, technology and expansion strategies, and this experience has uniquely positioned him to adjust the Company’s business strategies to respond to changing economic, regulatory and competitive conditions, and to discern and coordinate operational changes to match these strategies. His position on the Board also provides a direct channel of communication from senior management to the Board.

John M. Hausmann, C.P.A. Age 69.68. Mr. O’Neill isHausmann has been a founding member of The Kimberlite Group and is the co-CEO of Kimberlite Advisors, a registered broker-dealer that provides advisory and institutional capital raising services.self-employed certified public accountant since 1980, until he retired in 2022. Prior to forming Kimberlite in 2013,that time, he was the Chairman of Ranieri Partners Financial Services Group, a company formed to acquire and manage financial services companies, including money management and investment management firms.an accountant with Arthur Andersen. Mr. O’Neill also worked with Ranieri Partners’ investment funds and operating companies. In 2010, Mr. O’Neill retired from Sandler O’Neill & Partners, an investment banking firm he co-founded in 1988 that advises banks, thrifts and other domestic and international financial services firms on a broad range of strategic and transactional matters, including mergers and acquisitions and other strategic transactions, capital formation and financings, asset - liability management and asset purchases and dispositions. Prior to co-founding Sandler O’Neill, Mr. O’Neill was a Managing Director at Bear Stearns and was the Co-Manager of Bear Stearns’ Financial Services Group. Mr. O’Neill began his career at L.F. Rothschild & Co. in 1972, where he served as the Managing Director of the Bank Service Group. Mr. O’Neill currently serves on the Boards of Directors of the Archer Daniels Midland Company andHausmann is a member of the Compensation/Succession Committee for the Archer Daniels Midland Company. Mr. O’Neill is a member of the Corporate Governance and Nominating and the Human Resources Committees of the Company.

Mr. Hausmann brings to the Board, among other skills and qualifications, a comprehensive understanding of accounting, auditing and taxation principles based on his many years of experience as a certified public accountant. His experience as a member of the Audit CommitteesCommittee has provided him with a thorough knowledge of the Company’s internal controls and internal and external audit procedures. His tax and accounting practice and longtime residency in the Bank’s southernmost market territory have also provided him with a unique familiarity with the needs of the Bank’s small business and municipal customers and communities.

Benjamin Mackovak. Age 42. Mr. Mackovak is the Co-Founder and Managing Member of Strategic Value Bank Partners, an investment partnership specializing in community banks, since 2015. Prior to Strategic Value Bank Partners, Mr. Mackovak was the Founder and Portfolio Manager of Cavalier Capital, an investment firm based in Cleveland, Ohio, from 2012 to 2015. Mr. Mackovak was the Senior Analyst at Rivanna Capital, an investment firm based in Charlottesville, Virginia from 2006 to 2012. Mr. Mackovak worked at First American Trust as an Associate Portfolio Manager, an investment firm based in Newport Beach, California from 2004 to 2005. Mr. Mackovak began his career at Merrill Lynch.

Mr. Mackovak currently serves on the Board of Directors for People’s Bank of Commerce, Community Bank of the Bay, and Keystone Bank. Previously, he served on the Board of United Security Bancshares, First South Bancorp, Peak Bancorp, Foothills Community Bank, and First State Bank of Colorado. In his experience as a bank director, Mr. Mackovak has served on the Compensation Committee, Loan Committee, Corporate Governance Committee, Nominating Committee, ALCO Committee, Strategic Committee, IT Committee, M&A Committee, and Audit Committee of various community banks. In addition to serving on bank boards, Mr. Mackovak also serves on the Board of Directors for the Great Lakes Science Center.

Mr. Mackovak brings to the Board his experience as a director of other banks and his financial expertise.

Aaron J. O'Connor, C.P.A. Age 49. Mr. O'Connor is a partner and founder of the accounting firm Bridge CPA LLC, a full-service CPA firm providing audit, tax and business advisory services. Mr. O'Connor has over 25 years of public accounting experience, mainly providing audit/attestation and business consulting services. During this time, he has worked with clients of all sizes, from start-ups to helping take companies public on the NASDAQ and TSX. Mr. O'Connor's clients have been in financial services, manufacturing, distribution, and professional services. Mr. O'Connor's public accounting experience includes audit partner responsibilities with PKF Mueller from 2020 to 2023, and Crowe LLP from 2004 to 2019. Mr. O’Connor has been a member of the Board of Directors of the Bank since 2023.

Mr. O'Connor brings to the Board, among other skills and qualifications, a comprehensive understanding of accounting, auditing and taxation principles based on his many years of experience as a certified public accountant.

Glen R. Wherfel, C.P.A. Age 74. Mr. Wherfel has been a principal in the accounting firm of Wherfel & Associates since 1984 and President of Park Data Incorporated since 1980. Mr. Wherfel was a director of Success National Bank from 1993 to 2001, and of Success Bancshares from 1998 to 2001. He was the Chairman of Success National Bank’s Loan Committee and a member of its Asset Liability Management Committee. The Company acquired Success Bancshares and Success National Bank in 2001. Mr. Wherfel is a member of the Audit Committee and the Chairman of the Human Resources CommitteesCommittee of the Bank and Company. He is also the Chairman of the Corporate Governance and Nominating Committee, and as such, currently serves as the Lead Director of the Company.

Mr. WellsWherfel brings to the Board, among other skills and qualifications, substantial experience in municipal governmententrepreneurial finance and finance, communityoperations. His tax and economic developmentaccounting practice, longtime residency in the Bank’s northern market territory and servingservice as a director of Success National Bank have also provided him a unique familiarity with the needs of low-the Bank’s small business and moderate-income borrowersmunicipal customers and communities. His

Debra R. Zukonik. Age 61. Ms. Zukonik is the co-owner and Chief Credit Officer of Dare Capital Partners, LLC, which provides asset-based lending and accounts receivable factoring to selected small and medium-size businesses, and co-investment in asset-based lending or accounts receivable factoring facilities to selected financial institutions. Ms. Zukonik is a co-owner of NN6, LLC, which is a technology company providing specialty report capabilities for factoring software and a co-owner of Horizon ProMed, LP, which is a commercial real estate investment company. Ms. Zukonik is also a co-owner of FactorHelp, Inc., which is a factoring consulting firm, and a co-owner of Factor Solutions, LLC, which provides servicing for factoring transactions. Ms. Zukonik is a member of the Board of Directors of the American Factoring Association, and is a former member of the Advisory Board of the International Factoring Association, having served four times in the last 20 years, and she previously served on the Executive Committee of the Commercial Finance Association Board of Directors. Ms. Zukonik is a member of the Community and Environmental Committee of the Company.

Ms. Zukonik brings to the Board, among other skills and qualifications, substantial experience as an educator has also provided him with significantand expertise in secondarythe Commercial Finance industry with an extensive range of formal training and post-secondary vocational training applicable to the Bank’s customer serviceexpertise in commercial credit and support personnel.collections, underwriting, and financial and credit analysis.

In accordance with NASDAQ Stock Market board diversity disclosure requirements, below are diversity statistics for our eight Board members as of February 29, 2024.

Board Diversity Matrix (As of February 29, 2024) | |||||||

Total Number of Directors | 8 | ||||||

Female | Male | Non-Binary | Did Not Disclose Gender | ||||

Part I: Gender Identity | |||||||

Directors | 2 | 5 | 1 | ||||

Part II: Demographic Background | |||||||

African American or Black | 1 | ||||||

Alaskan Native or Native American | |||||||

Asian | |||||||

Hispanic or Latinx | |||||||

Native Hawaiian or Pacific Islander | |||||||

White | 2 | 4 | |||||

Two or More Races or Ethnicities | |||||||

LGBTQ+ | |||||||

| Did Not Disclose Demographic Background | 1 | ||||||

Director Independence

The Board of Directors has determined that, except for Mr. Gasior, who serves as the Chairman, Chief Executive Officer and President of the Company, each of the Company’s directors is “independent” as defined in Rule 5605(a)(2) of the listing standards of the NASDAQ Stock Market. The Bank made certain secured real estate loans to Ms. Francis and her spouse prior to Ms. Francis’ appointment as a director in 2006, and these loans were considered to be grandfathered from the Bank’s practice of not making loans to directors or executive officers. This extension of credit was made in the ordinary course of business on substantially the same terms, including interest rate and collateral, as those prevailing at the time for comparable transactions with persons not related to the Bank, does not involve more than normal risk of collectability or present other unfavorable features, and is not past due or classified as nonaccrual, restructured or a potential problem loan.

Executive Officers Who Are Not Directors

Set forth below is information, with age information as of December 31, 2015,2023, regarding the principal occupations for at least the past five years of the individuals who serve as executive officers of the Company and/or the Bank who are not directors of the Company or the Bank. All executive officers of the Company and the Bank are elected annually by their respective Boards of Directors and serve until their successors are elected and qualify. No executive officer identified below is related to any director or other executive officer of the Company or the Bank. Except as indicated elsewhere in this Proxy Statement, there are no arrangements or understandings between any officer identified below and any other person pursuant to which any such officer was selected as an officer.

Gregg T. Adams. Age 65.64. Mr. BrennanAdams has served as the SecretaryPresident of the Marketing and General CounselSales Division of the Bank since 20002015 and of the Company since its formation in 2004, and held the same positions with BankFinancial MHC and BankFinancial Corporation, a federal corporation, from 2000 to 2005. Mr. Brennan also serves aswas the Executive Vice President of the Corporate AffairsMarketing and Sales Division of the Company and the Bank. Mr. Brennan was a practicing attorneyBank from 1975 until 2000. Prior2001 to joining the Bank

Paul A. Cloutier,Cloutier. C.P.A.

John G. Manos.

AgeMarci L. Slagle. Age 54. Ms. Slagle has served as the President of the Bank's Equipment Finance Division since February 2020. She manages the corporate and governmental, middle market and small ticket equipment finance and leasing departments. Ms. Slagle is a Certified Lease Finance Professional (“CLFP”) with over 25 years’ experience in the commercial equipment leasing/finance industry. Ms. Slagle is a current member of the Equipment Finance and Lease Association Steering Committee – Middle Market Leasing, and she is also an Executive Committee member and past President of the CLFP Foundation.

The following table sets forth, as of

| Name and Address of Beneficial Owners | Amount of Shares Owned and Nature of Beneficial Ownership(1) | Percent of Shares of Common Stock Outstanding | |||||

| Principal Trust Company 1013 Centre Road Wilmington, Delaware 19805 | |||||||

| As Trustee fbo BankFinancial FSB ESOP Plan | 1,675,915 | (2) | 8.41% | ||||

| As Trustee fbo BankFinancial and Subsidiaries 401(k) Plan | 668,032 | (2) | 3.35% | ||||

| Combined holdings as Trustee | 2,343,947 | (3) | 11.76% | ||||

| Basswood Capital Management, L.L.C. 645 Madison Avenue, 10th Floor New York, New York 10022 | 1,781,913 | (2) | 8.94% | ||||

| Dimensional Fund Advisors LP 6300 Bee Cave Road Building One Austin, Texas 78746 | 1,655,566 | (2) | 8.30% | ||||

| PL Capital, LLC 20 East Jefferson Ave., Suite 22 Naperville, Illinois 60540 | 1,630,170 | (4) | 8.18% | ||||

| Black Rock, Inc. 40 East 52nd Street New York, New York 10022 | 1,266,521 | (2) | 6.35% | ||||

| Directors and Nominees | |||||||

| Cassandra J. Francis | 84,498 | (5) | * | ||||

| F. Morgan Gasior | 477,635 | (6) | 2.38% | ||||

| John M. Hausmann | 124,450 | (7) | * | ||||

| Thomas F. O’Neill | 30,100 | (8) | * | ||||

| John W. Palmer | 1,656,420 | (4), (9) | 8.30% | ||||

| Terry R. Wells | 113,498 | (10) | * | ||||

| Glen R. Wherfel | 128,618 | (11) | * | ||||

| Named Executive Officers (other than Mr. Gasior): | |||||||

| Paul A. Cloutier | 191,087 | (12) | * | ||||

| James J. Brennan | 266,802 | (13) | 1.33% | ||||

| John G. Manos | 164,231 | (14) | * | ||||

| William J. Deutsch, Jr. | 57,029 | (15) | * | ||||

| All Directors, Nominees and Executive Officers (including Named Executive Officers) as a Group (12 persons) | 3,459,172 | (16) | 16.69% | ||||

Name and Address of Beneficial Owners | Amount of Shares Owned and Nature of Beneficial Ownership (1) | Percent of Shares of Common Stock Outstanding | ||

M3 Funds, LLC 2070 E 2100 S, Suite 250 Salt Lake City, Utah 84109 | 1,155,303 | (2) | 9.27% | |

Dimensional Fund Advisors LP 6300 Bee Cave Road, Building One Austin, Texas 78746 | 868,839 | (2) | 6.97% | |

Voya Institutional Trust Company As Trustee fbo BankFinancial and Subsidiaries 401(k) Plan | 858,372 |

| 6.89% | |

Alliance Bernstein L.P. 501 Commerce Street Nashville, Tennessee 37203 | 718,811 | (2) | 5.77% | |

Renaissance Technologies LLC 800 Third Avenue New York, New York 10022 | 699,115 | (2) | 5.61 % | |

Black Rock, Inc. 50 Hudson Yards New York, New York 10001 | 678,311 | (2) | 5.44 % | |

Strategic Value Investors, LP 127 Public Square, Suite 1510 Cleveland, Ohio 44114 | 645,000 | (3) | 5.18 % | |

Directors and Nominees | ||||

Cassandra J. Francis | 40,444 | * | ||

F. Morgan Gasior | 327,696 | (4) | 2.63 % | |

John M. Hausmann | 69,049 | * | ||

| Aaron J. O'Connor | 4,184 | * | ||

Benjamin Mackovak | 645,000 | (3) | 5.18 % | |

Terry R. Wells | 56,384 | * | ||

Glen R. Wherfel | 106,085 | (5) | * | |

Debra R. Zukonik | 3,650 | * | ||

Named Executive Officers (other than Mr. Gasior): | ||||

Paul A. Cloutier | 89,373 | (6) | * | |

Gregg T. Adams | 96,275 | (7) | * | |

All Directors and Executive Officers (including Named Executive Officers) as a Group (12 persons) | 1,618,636 | 12.99 % |

(1) | |

The information reflected in this column is based upon information furnished to us by the persons named above and the information contained in the records of our stock transfer agent. The nature of beneficial ownership for shares shown in this column, unless otherwise noted, represents sole voting and investment power. |

(2) | Amount of shares owned and reported on the most recent Schedule 13G filing with the SEC, reporting ownership as of December 31, 2023. |

| (3) | Amount of shares owned and reported on the most recent Schedule |

| (4) | |

Includes |

(5) | Includes |

(6) | Includes |

| Includes |

Securities Authorized for Issuance

The Company has no securities authorized for issuance under any equity compensation plan.

Delinquent Section 16(a) Beneficial Ownership Reporting Compliance

The Company’s executive officers, directors and any beneficial owners of greater than 10% of the outstanding shares of the Company’s common stock are required to file reports with the SEC disclosing beneficial ownership and changes in beneficial ownership of the Company’s common stock. SEC rules require disclosure if an executive officer, director or 10% beneficial owner fails to file these reports on a timely basis. Based on the Company’s review of ownership reports required to be filed for the year ended

December 31,The Company has adopted a Code of Ethics for Senior Financial Officers that applies to the Company’s principal executive officer, principal financial officer, principal accounting officer, and persons performing similar functions. A copy of the Company’s Code of Ethics was previously filed as Exhibit 14 to the Company’s Annual Report on Form 10-K for the year ended December 31, 2005. Amendments to and waivers from the Code of Ethics for Senior Financial Officers will be disclosed on the Company website, www.bankfinancial.com. The Company has also adopted a Code of Business Conduct, pursuant to the listing standards of the NASDAQ Stock Market that applies generally to the Company’s directors, officers, and employees.

Leadership Structure

. The Company’s Board of Directors has a distributed leadership structure. The Board has established a standing Executive Committee, which currently consists of the Chief Executive Officer and two independentThe Chair of the Corporate Governance and Nominating Committee to provide that the Chair of this committee will serveserves as the Board’s Lead Director. The Lead Director calls and presides at all executive sessions or special meetings of the Board’s outside, independent directors and provides feedback to the Chief Executive Officer regarding the same; works with the Chairs of the other committees of the Board to ensure coordinated coverage of the Board’s duties and responsibilities; serves as a supplemental point of contact for Board members and stockholders; serves as a liaison between the

The Chairman of the Board coordinates the Board’s functions, including the activities of the Board’s committees, with the execution of the Company’s business plan and day-to-day operations. Although the Chairman also presides over Board meetings as provided in the Company’s bylaws, the charter of the Corporate Governance and Nominating Committee was amended in 2010 to formalize the Board’s practice of permittingprovides that any director tomay place any item on the agenda for any Board meeting.

The Board periodically meets outside the presence of the Chief Executive Officer. The independent members of the Board also conduct a periodic review of the Company’s financial condition, results of operation, long-term planning, management structure and internal governance practices. The Board utilizes the findings and recommendations resulting from its review to revise and enhance its oversight, as appropriate.

The Board does not have a policy requiring the separation of the offices of Chairman and Chief Executive Officer, and Mr. Gasior currently serves in both capacities. The Board believes that the selection of its Chairman should be based upon the Board’s assessment of the Company’s current operating needs, the suitability of the individual to effectively discharge the duties of the Chairman and the leadership structure that will best serve the interests of the Company and its stockholders. The Board believes that combining the offices of Chairman and Chief Executive Officer is currently an effective governance structure because it provides an efficient and unified responsibility and mechanism for the coordination of the activities of the Board of Directors and those of management. The Board also believes that the Lead Director position, its policy of universal Board agenda access and its practice of conducting periodic meetings outside the presence of the Chief Executive Officer achieve benefits that are equivalent to those that might result from separating the offices of Chairman and Chief Executive Officer.

Role in Risk Oversight

. The Board is actively involved in the oversight of risks that could affect the Company, through, among other things, its adoption of policies andThis leadership and risk management structure is designed to ensure that financial, risk, internal control reporting and market information are provided directly to the independent directors of the Company and acted upon as necessary. Taken together, the Board believes that it has an effective leadership structure controlled by independent directors, with open meeting agendas and an established mechanism for oversight and evaluation of the Company as well as the Board’s and management’s execution of their respective responsibilities.

Attendance at Annual Meetings of Stockholders

Although the Company does not have a formal written policy regarding director attendance at annual meetings of stockholders, directors are requested to attend these meetings absent unavoidable scheduling conflicts. All of the Company’s then existing directors attended the 2023 Annual Meeting of Stockholders.

Meetings and Committees of the Board of Directors

Board of Directors and Committees.

The business of the Company is conducted at regular and special meetings of the Board of Directors and its committees. In addition, the “independent” members of the Board of Directors, as defined in Rule 5605(a)(2) of the listing standards of the NASDAQ Stock Market, meet in executive sessions. The standing committees of the Board of Directors of the Company are the Executive, Audit, Corporate Governance and Nominating, and Human Resources Committees. During the year ended December 31,The table below shows current membership for each of the standing Board committees:

| Directors | Executive Committee | Audit Committee | Corporate Governance and Nominating Committee | Human Resources Committee | ||||

| Cassandra J. Francis | ü | ü | ||||||

| F. Morgan Gasior | Chair | |||||||

| John M. Hausmann | ü | Chair | ü | |||||

| Thomas F. O’Neill | ü | ü | ||||||

| John W. Palmer | ü | ü | ||||||

| Terry R. Wells | ü | ü | Chair | Chair | ||||

| Glen R. Wherfel | ü | ü | ||||||

| Meetings held during 2015 | — | 6 | 1 | 3 | ||||

Directors |

| Executive Committee |

| Audit Committee |

| Corporate Governance and Nominating Committee |

| Human Resources Committee | Community & Environmental Committee | |

Cassandra J. Francis |

|

|

|

|

|

| ✓ | ✓ | ||

F. Morgan Gasior |

| Chair |

|

|

|

|

|

| ||

John M. Hausmann |

| ✓ |

| Chair |

| ✓ |

| ✓ | ||

Terry R. Wells |

| ✓ |

| ✓ |

|

|

| ✓ | Chair | |

Glen R. Wherfel |

|

|

| ✓ |

| Chair |

| Chair | ||

| Debra R. Zukonik | ✓ | |||||||||

Meetings held during 2023 |

| 1 |

| 4 |

| 1 |

| 1 | 1 |

Executive Committee.

The Executive Committee is authorized to act with the same authority as the Board of Directors between meetings of the Board of Directors, subject to certain limitations contained in the bylaws of the Company.Audit Committee.

The Board of Directors has adopted a written charter for the Audit Committee, which was attached as Appendix A to the 2023 ProxyCorporate Governance and Nominating Committee.

The Board of Directors has adopted a written charter for the Corporate Governance and Nominating Committee, whichThe Corporate Governance and Nominating Committee identifies nominees by first evaluating the current members of the Board of Directors who are willing to continue in service. Current members of the Board of Directors with skills and experience that are relevant to the Company’s business and who are willing to continue in service are considered for re-nomination, balancing the value of continuity of service by existing members of the Board of Directors with that of obtaining a new perspective. If vacancies on the Board of Directors arise, or if a current director is not nominated for re-election, the Corporate Governance and Nominating Committee will determine the skills and experience desired of a new nominee, solicit suggestions for director candidates from all members of the Board of Directors, and may engage in other search activities. During the year ended

Candidates for a directorship should possess specific attributes, including integrity and a devotion to ethical behavior, a primary interest in the well-being of the Company, a capacity for independent judgment, good business acumen, the capacity to protect confidential information, an ability to work as a member of a team and a willingness to evaluate other opinions or points of view. In addition to examining a candidate’s qualifications in light of the above attributes, the Corporate Governance and Nominating Committee would also consider the overall character of the candidate and any existing or potential conflict of interest, the candidate’s willingness to serve and ability to devote the time and effort required, the candidate’s record of leadership, and the ability to develop business for the Company and its subsidiaries.

The Corporate Governance and Nominating Committee and the Board of Directors nominate candidates for election to the Company’s Board of Directors based on the candidate’s experience and expertise applicable to the current and expected future business operations of the Company. There is no formal policy with regard to the consideration of diversity in identifying a

The Corporate Governance and Nominating Committee may consider qualified candidates for a directorship suggested by the stockholders of the Company. Stockholders may suggest a qualified candidate for a directorship by writing to BankFinancial Corporation at 15W06060 North Frontage Road, Burr Ridge, Illinois 60527, Attention: James J. Brennan, Secretary, and providing the information described in the Company’s bylaws concerning the suggested candidate. A suggestion made to the Company’s Secretary concerning a potential candidate for a directorship will not constitute a nomination of the suggested candidate for election as a director. All nominations of candidates for election as a director must strictly comply with the applicable requirements and time limits summarized in “Advance Notice of Business to be Conducted at an Annual Meeting.”

Human Resources Committee.

The Board of Directors has adopted a written charter for the Human Resources Committee of the Company. The Charter of the Human Resources Committee of the Company was attached as Appendix B to the 2023 ProxyCommunity and Environmental Committee. The Board of Directors has adopted a written charter for the Community and Environmental Committee of the Company. The scope of the Community and Environmental Committee responsibilities shall include monitoring and oversight of the policies, key controls and practices, and results with respect to the community and environmental topics. The Committee shall also conduct and facilitate reviews, meetings, assessments and take such other actions necessary and appropriate to its Scope of Responsibilities.

In accordance with the applicable rules of the SEC, the Audit Committee has prepared the following report for inclusion in this Proxy Statement:

As part of its ongoing activities, the Audit Committee has:

• | reviewed and discussed with management the Company’s audited consolidated financial statements for the year ended December 31, 2023; |

• | discussed with the Company’s independent registered public accounting firm the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board and the Commission; and |

• | received the written disclosures and the letter from the independent registered public accounting firm required by applicable requirements of the Public Company Accounting Oversight Board regarding the firm’s communications with the Audit Committee concerning independence, and has discussed with the independent registered public accounting firm their independence. |

Based on the review and discussions referred to above, the Audit Committee recommended to the Board of Directors that the audited consolidated financial statements be included in the Company’s Annual Report on Form 10-K for the year ended

December 31,This report has been provided and is respectfully submitted by the Audit Committee:

John M. Hausmann, C.P.A., Chairman

Terry R. Wells

Glen R. Wherfel, C.P.A.

The Company’s Audit Committee has engaged Crowe HorwathRSM US LLP (“RSM”) to act as the Company’s independent registered public accounting firm for the year ending

The Board of Directors recommends a vote “FOR” the ratification of the engagement of Crowe HorwathRSM US LLP as the Company’s independent registered public accounting firm for the year ending

Accounting Fees and Services

RSM acted as the Company’s independent registered public accounting firm for its fiscal years ended December 31, 2023 and 2022. Set forth below is certain information concerning aggregate fees billed for professional services rendered by Crowe HorwathRSM during the years ended December 31, 20152023 and 2014:

Audit Fees.

The aggregate fees billed to the Company byAudit-Related Fees.

Tax Fees.

The aggregate fees billed to the Company byAll Other Fees.

There were no other fees billed for professional services rendered byAudit Committee Pre-Approval Policy

The Audit Committee pre-approves all auditing services and permitted non-audit services (including the fees and terms thereof) to be performed for the Company by Crowe Horwath,RSM, subject to the

This CompensationNarrative Discussion and Analysisof Executive Compensation describes the Company’s compensation philosophy and policies for 20152023 as applicable to the executive officers named in the Summary Compensation Table.Table (the “Named Executive Officers”). This section explains the structure and rationale associated with each material element of the named executive officers’Named Executive Officers’ compensation, and it provides context for the more detailed disclosure tables and specific compensation amounts provided in the following section. It is important to note that the Company and the Bank share an executive management team, and except for awards made pursuant to the Company’s 2006 Equity Incentive Plan (the “2006 EIP”), the members of the executive management team are compensated by the Bank rather than the Company and the Company reimburses the Bank for its services to the Company through intercompany expense allocations.

Pursuant to its Charter, the Human Resources Committee of the Company is responsible for the execution of the Board of Directors’ responsibilities with respect to equity-based compensation, performance evaluation and succession planning for the Company’s Chief Executive Officer and other named executive officers of the Company. The Human Resources Committee of the CompanyBank is also responsible for the submissionexecution of an annual report on executive compensation tothe responsibilities of the Board of Directors of the Bank with respect to cash-based compensation, employee benefits and perquisites, performance evaluation and succession planning for inclusion in the Company’s Annual Report on Form 10-K.Bank’s Chief Executive Officer, and other senior officers of the Bank. The Human Resources Committee of the Bank communicates its actions and decisions to the Human Resources Committee of the Company. The Human Resources Committee of the Company is comprised of Messrs. WellsWherfel (Chairman), Hausmann O’Neill, Palmer, and Wherfel,Wells and Ms. Francis, each of whom is expected to serve on the committee through the conclusion of the Company’s Annual Meeting of Stockholders on

The overall objective of the Company’s and the Bank’s compensation programs is to align executive officer compensation with the success of meeting strategic, financial and management objectives and goals. The programs are designed to create meaningful and appropriate incentives to manage the business of the Company and the Bank successfully and to align management interests with those of the stockholders of the Company. The program is structured to accomplish the following:

| • | encourage a consistent and competitive return to stockholders over the long-term; | |

| • | maintain a corporate environment that encourages stability and a long-term focus for the primary constituencies of the Company and the Bank, including employees, stockholders, communities, clients and government regulatory agencies; | |

| • | maintain a program that: |

◦ | clearly motivates personnel to perform and succeed according to the current goals of the Company and the Bank; |

◦ | provides management with the appropriate empowerment to make decisions that benefit the primary constituents; |

◦ | aligns incentive compensation practices to risk-taking activities; | |

◦ | attracts and retains key personnel critical to the long-term success of the Company and the Bank; |

◦ | provides for management succession planning and related considerations; |

◦ | encourages increased productivity; |

◦ | provides for subjective consideration in determining incentive and compensation components; and |

◦ | ensures that management: |

▪ | fulfills its oversight responsibility to its primary constituents; |

▪ | conforms its business conduct to the Company’s and the Bank’s established ethical standards; |

▪ | remains free from any influences that could impair or appear to impair the objectivity and impartiality of its judgments or treatment of the constituents of the Company and the Bank; and |

▪ | avoids any conflict between its responsibilities to the Company and the Bank and each executive officer’s personal interests. |

Mr. Gasior is the only director of the Company and the Bank who is also an executive officer of the Company and/or the Bank. Mr. Gasior does not participate in the decisions of the Boards of Directors of the Company or the Bank or their respective Human Resources Committees concerning his compensation. No executive officer of the Company or the Bank has served on the Board of Directors or on the compensation committee of any other entity that had an executive officer serving on the Company’s Board of Directors or Human Resources Committee.

The Human Resources Committee of the Company engaged Frederic W. Cook & Co., Inc. (“Cook & Co.”) to assist in the preparation of the compensation aspects of reports filed with the SEC and to be available for consultations with outside counsel to the Human Resources Committee of the Company. The Human Resources Committee of the Company has received and reviewed the Cook & Co. consultant independence letter and independence policy addressing factors identified by SEC rules to determine whether certain conflicts of interest disclosures must be made. Cook & Co. believes that there is no conflict of interest in its role as an advisor to the Human Resources Committee of the Company. The following factors were assessed by the committee: Cook & Co.’s provision of services other than the executive and non-employee director compensation matters; the amount of fees received from the Company by Cook & Co. as a percentage of the total revenue of Cook & Co.; the policies and procedures of Cook & Co. that are designed to prevent conflicts of interest; the extent of any business or personal relationships with any member of the committee or any executive officer of the Company or the Bank; and any ownership of the Company’s stock by individuals on the consulting team employed by Cook & Co. After considering these and other factors in their totality, no conflicts of interest with respect to Cook & Co.’s advice were identified by the Board or the Human Resources Committee of the Company.

Business Plan Objectives.

The Boards of Directors of the Company and the Bank periodically conduct a review of current and anticipated business conditions in the context of the Company’s and the Bank’s financial and competitive position. TheThe Human Resources Committees of the Company and the Bank considered the Company’s and the Bank’s performance within the context of the 2015 business planBusiness Plan and management’s overall performance, weighing numerous factors within and outside of management’s control.

Corporate Performance and PeerIndustry Comparison.

For purposes of comparative analysis in assessing corporate performance, the Company generallygenerally considers commercial banks and savings institutions of similar asset size, capital ratios, and/or geography. Given the ever-changing landscape within the banking industry, there is no specifically defined group of companies that is utilized for this analysis. The group of comparative financial institutions used in 2015for 2023 to assess overall performance consisted of local publicly-held financial institutions.financial institutions located in the Chicago MSA, an immediately adjacent MSA or the State of Illinois with assets of $1.0 billion to $6.0 billion. The local financial institutions that were considered in 2015 included First Midwest Bancorp, Inc. (FMBI), MBfor 2023 consisted of Waterstone Financial, Inc. (MBFI)(WSBF), WintrustFinward Bancorp (FNWD), and First Business Financial Corporation (WTFC) and PrivateBancorpServices, Inc. (PVTB)(FBIZ). A broader group consisting of these publicly-held institutions and a number of privately-held local financial institutions was used to evaluate the improvements that occurredis also considered in the Company’s earnings, loan portfolio composition and asset quality performance metrics.

The Boards of Directors of the Company and the Bank believe that peerindustry comparison is a useful tool for assessing business performance, staying competitive in the marketplace and attracting and retaining qualified executives. While the Human Resources Committees believe that it is prudent to consider peeruse industry comparison data in determining compensation practices, they do not establish empirical parameters or benchmarks for using this data. Rather, where necessary, the Human Resources Committee of the Bank uses peerindustry comparison data to confirm that executive compensation is reasonable relative to competing organizations.

Performance Reviews and Role of Executives in Committee Meetings.

Management reports to the Boards of Directors of the Company and the Bank at least annually on its progress in achieving the strategic, financial and management objectives established by the business plan. The Boards of Directors of the Company and the Bank then consider the overall performance of the Company and the Bank and the named executive officers in the context of these objectives, weighing numerous factors and conditions within and outside of management’s control.The Boards of Directors and the Human Resources Committees exclude the Chief Executive Officer and all other named executive officersNamed Executive Officers from their discussions and formal meetings concerning their compensation, except to receive the results of the decisions made and other relevant information.

Information Resources and Role of Compensation Consultants.

In reviewing current and proposed compensation levels forAlignment of Risk and Performance-Based Compensation. The Code of Business Conduct for the Company and the Bank incorporates a NASDAQ Clawback Policy for the Executive Officers of the Company and the Bank that provides for the recovery of Erroneously Awarded Compensation in the event the Company is required to prepare an Accounting Restatement. For those not covered by the NASDAQ Clawback Policy, the Code of Business Conduct for the Company and the Bank includes provisions for the recovery (also known as “clawback”) of performance-based incentive compensation paid in or after 2023 in certain situations involving a restatement of financial reporting for a period up to three years from the date the restated financial statements are first filed with the SEC. In addition, incentive compensation plans adopted by the Bank that are directly related to the volumes and pricing of extensions of credit provide for the exclusion or deferral of incentive-based compensation based on either the inherent risk of the extension of credit or the risk rating assigned to the credit by a committee independent of the loan origination process.

General.

AllBase Salary.

Generally, base salary levels are established based on job descriptions and responsibilities, either temporary or permanent in nature (including any revisions or proposed revisions thereto), competitive conditions and general economic trends in the context of the Bank’s financial and franchise condition, and performance. A discussion of changes in base salaries for eachThe base salaries of the named executive officersNamed Executive Officers for 20162024 are as follows:

Name | Position | 2024 Base Salary | |||

F. Morgan Gasior | Chairman of the Board, Chief Executive Officer and President | $ | 507,756 | ||

Paul A. Cloutier | Executive Vice President and Chief Financial Officer | $ | 333,125 | ||

Gregg T. Adams | Marketing & Sales President - Bank | $ | 279,269 | ||

Cash Incentive Plan Compensation.

The Bank maintains numerousDiscretionary Non-EquityCash Bonus.

Prohibited Transactions Involving Shares Issued by BankFinancial Corporation. The awards of discretionary non-equity bonus paymentsInsider Trading Policy for the named executiveCompany and the Bank includes provisions prohibiting directors, officers are discussedand employees from purchasing shares of common stock issued by the Company in “Conclusionsa margin account, or pledging such shares as collateral for a loan. In addition, the Year Ended December 31, 2015.”

401(k) Plan.

The Company has a tax-qualified defined contribution retirement plan covering all of its eligible employees. Employees are eligible to participate in the plan after attainment of age 21 and completion ofAll Other Compensation and Perquisites.

To the extent applicable, the Human Resources Committees of the Company and the Bank review and monitor the level of other compensation and perquisites provided by the Company or the Bank, respectively, to theExecutive Summary

. The following is a summary of the compensation decisions the Human Resources Committees made with respect to the• | Earned 2023 cash incentive compensation plan payments were paid to the Chief Executive Officer, the Chief Financial Officer and the Marketing and Sales President. | |

| • | In March 2023, the base salaries of the Chief Executive Officer and the Marketing and Sales President increased by 3.0%. The Chief Financial Officer received a 4.4% increase in base salary in 2023. | |

• | In March 2024, the base salaries of the Chief Executive Officer, the Chief Financial Officer and the Marketing and Sales President increased 2.5%. |

Review of Chief Executive Officer

. The Human Resources Committee of the Bank met outside the presence ofEarnings Per Share. The Human Resources Committee determined that the Earnings Per Share weighting for the Chief Executive Officer should remain constant at 40% of the total plan weighting. The goal of the Company has been to achieve a consistent earnings result of $1.00 per year Earnings Per Share. The Business Plan and the extentBankFinancial Corporation share repurchase plan are coordinated as feasible to achieve the targeted results. Based on the full-year 2023 results, the Human Resources Committee determined that Earnings Per Share were 74% of the target Earnings Per Share objective for 2023.

The Company’s share price decreased from $10.53 to $10.26 (2.6%) in 2023, with a one-year total shareholder return of 2.05% and three-year total shareholder return of 32.14%. The ABAQ Community Bank stock index decreased by 5.3% for the one-year period and increased by 13.6% for the three-year period.

Net Commercial Loan Growth & Loan Originations. The failures of Silicon Valley Bank, Signature Bank and First Republic in the first half of 2023 required the Bank to immediately emphasize on-balance sheet liquidity. At the beginning of 2023, the Bank’s liquidity in 2023 primarily resulted from scheduled repayments of equipment finance exposures and scheduled maturities of investment securities, which establishedwere weighted to the second half of 2023. Accordingly, the Bank decided to conserve liquidity by materially reducing term-structured loan originations through the third quarter of 2023. Due to the change in the Business Plan to emphasize on-balance sheet, the Bank’s loan portfolio declined by $176 million (14.3%), primarily due to receipt of $201 million in total principal payments within the equipment finance portfolio, which were not replaced by new originations in 2023. Notwithstanding the change in Business Plan strategy, the Bank earned a higher interest rate on its cash and short-term investments compared to the weighted-average interest rate earned on the scheduled repayments and matured securities during 2023. The Human Resources Committee determined that each of the Net Commercial Loan Growth & Loan Originations category weightings should remain constant at 5% of the total plan weighting for 2023 to retain the continued long-term focus on loan portfolio composition and growth to achieve Earnings Per Share and franchise objectives. Based on the short-term changes in the Business Plan strategy for 2023, the Human Resources Committee determined that Net Commercial Loan Growth and Loan Originations met expectations for 2023.

Securities Portfolio. The Human Resources Committee determined that the Securities Portfolio category weighting should remain constant at 5% of the total plan weighting for 2023. The Bank’s securities portfolio maintained a relatively short duration and laddered maturities, which enabled the Bank to improve liquidity and earnings through re-deployment of matured securities and the eight month earn-back of the $335,000 (after-tax) loss on the sale of $44 million in investment securities incurred in the first quarter of 2023. The Bank also improved its Community Reinvestment Act investment portfolio from $3.6 million as of December 31, 2022 (54% of target CRA investment level) to $7.5 million as of December 31, 2023 (117% of target CRA investment level). As of December 31, 2023, the Accumulated Other Comprehensive Income (AOCI) adjustment for the securities portfolio was (1.6%) of Bank tangible capital. The Human Resources Committee determined that the Securities Portfolio met expectations for 2023.

Asset Quality. The Human Resources Committee determined that the Asset Quality category should remain constant at 20% of the total plan weighting for 2023. The overall metrics for Asset Quality declined principally due to the two U.S. Government equipment finance transactions and one Middle Market equipment finance transaction placed on non-accrual status in the first half of 2023. Excluding the two U.S. Government equipment finance transactions, the Bank’s Asset Quality was consistent with the Bank’s historical asset quality results, with positive trends and action taken with respect to other classified, criticized and watch list credit exposures. Notwithstanding the foregoing, the Human Resources Committee determined that Asset Quality was below expectations due to the balances of non-accrual loans and non-performing assets as of December 31, 2023.

Internal Controls. The Human Resources Committee determined that the Internal Controls category weighting should remain constant at 10% of the total plan weighting for 2023. The Human Resources Committee determined that the results of the Bank's operations and audits with respect to information security, regulatory compliance and the system of internal controls met expectations for 2023.

Leadership & Planning. The Human Resources Committee determined that the Leadership & Planning category weighting should remain at 15% of the total plan weighting for 2023. The Chief Executive Officer responded to the banking industry developments which occurred in the first quarter of 2023 with changes to the Bank’s liquidity posture, while improving earnings due to the pricing of scheduled loan payments and maturing securities. Notwithstanding the $113 million decline in deposits in 2023, the Bank’s liquidity improved to 12% of Cash to Total Assets as of December 31, 2023 from 4% Cash to Total Assets as of December 31, 2022. The improved liquidity also further supported growth in interest income given the increases in short-term interest rates due to Federal Reserve monetary policy actions. The Bank maintained a balanced interest rate risk position in 2022 to 2023, with the additional liquidity generated during 2023 creating more earnings exposure to a future material decline in short-term interest rates as of December 31, 2023 but stable to rising earnings should interest rates remain constant or increase in future periods.

The Bank’s deposit portfolio declined primarily due to the utilization of available funds by retail borrowers in an inflationary environment and the use of low-yielding cash deposits in lieu of commercial line utilization by commercial borrowers. The Bank’s change in the cost of funds was consistent with the 2023 Business Plan. Consolidated insured deposits were 86% of total deposits as of December 31, 2023, due in part to the Bank’s rapid deployment of reciprocal insured deposit products and customer outreach for “FDIC Insurance Coverage Reviews” for depositors with greater than $250,000 held at the Bank.